Best Describes Audit in the Context of Accounting

General supervision of the audit. Which of these statements best describes the context for entrepreneurship.

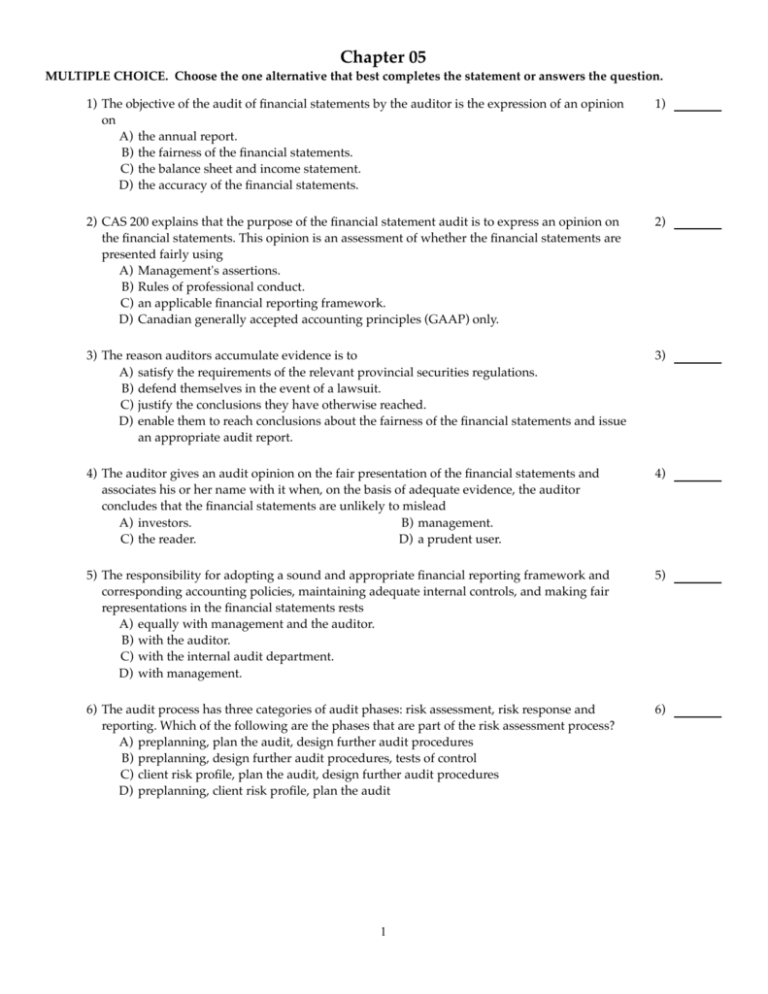

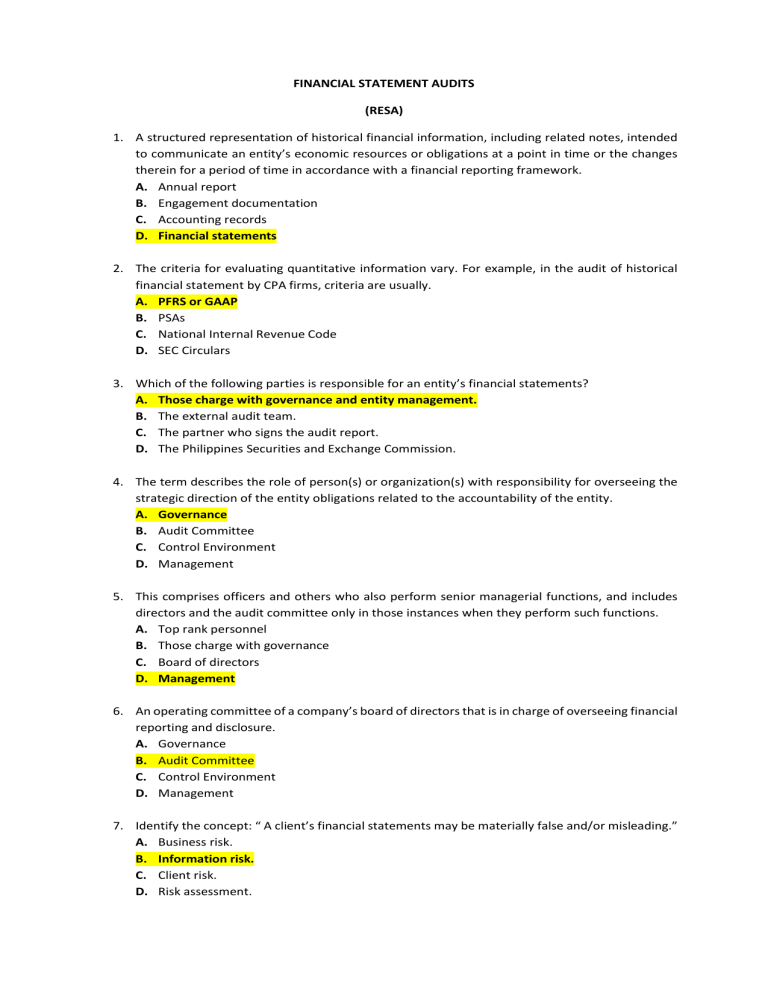

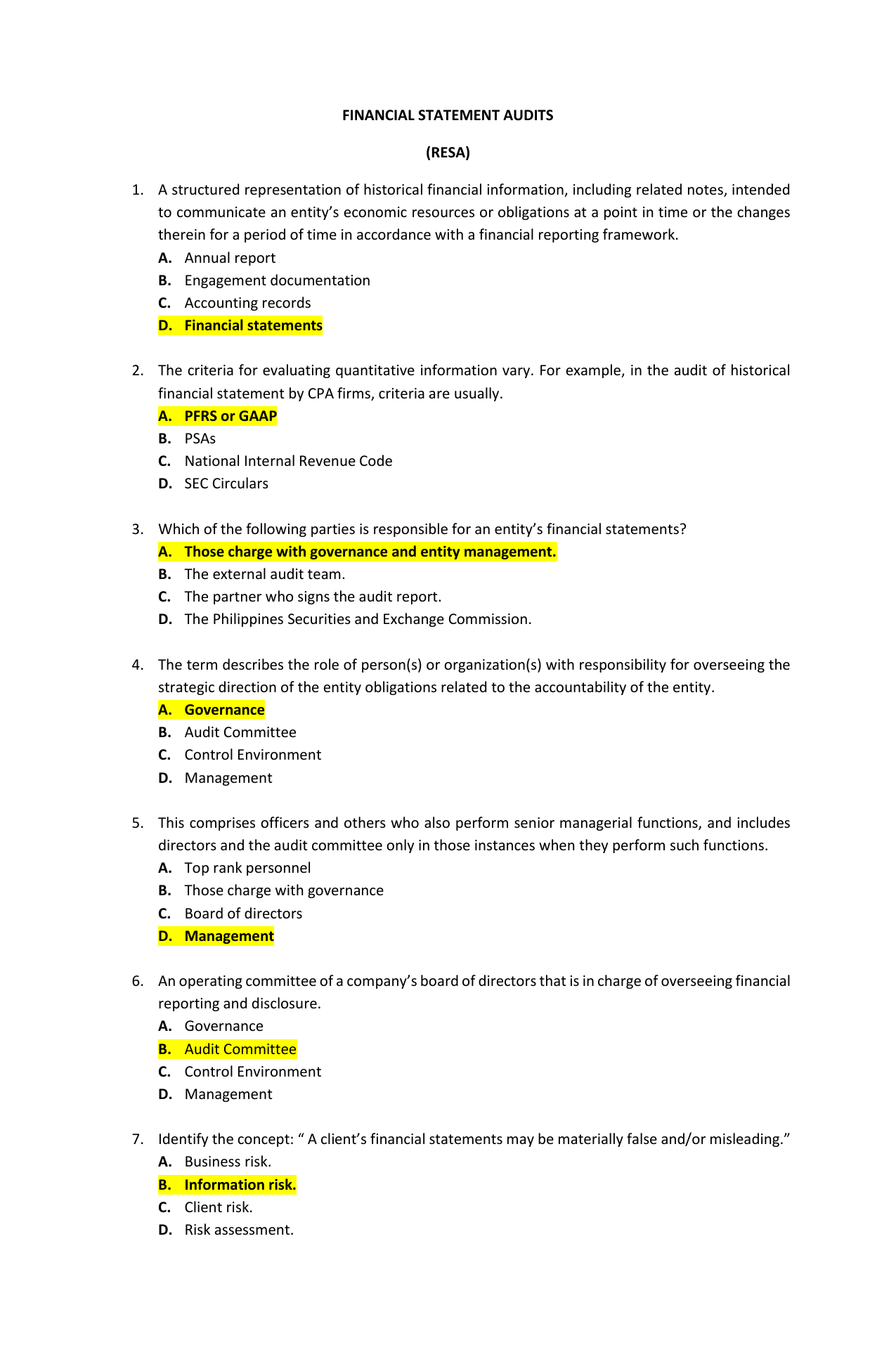

Auditor s satisfaction as to the reliability of an assertion being made by one party for use by another party.

. CPAs approach to the. To detect errors or irregularities. Even if an auditor assesses this exposure as low the auditor does not per-form less extensive audit procedures than otherwise is appropriate under generally accepted auditing standards.

The generally accepted auditing standard that requires Adequate technical training and easy proficiency is normally interpreted as requiring the auditor to have. Carmichael asked about Statement of Auditing Standards SAS 142 Audit Evidence and its treatment of audit evidence and cognitive bias. Which of the following is the single feature that most clearly distinguishes auditing attestation and assurance.

States a conclusion about a written assertion. 1 1 Question 17 There are four conditions that give rise to the need for independent audits of financial statements. This problem has been solved.

Audit in accordance with generally accepted auditing standards and has reported appropriately on those financial statements. The procedures specifically outlined in an audit program are primarily designed to a. Which of the following best describes the scope of internal auditing as it has developed to date.

Any disputes over significant accounting issues have been settled to the auditors satisfaction. Previous question Next question. 100 4 ratings What is an audit in the context of financial accounting.

The risk that the auditor will provide an unqualified opinion on financial statements that are in fact materially. Entrepreneurship takes place in large businesses. See the answer See the answer See the answer done loading.

The auditors responsibility is confined to his expression of. Which of the following best describes the concept of audit risk. Who are the experts.

So an audit is an assessment of an individual process system company organizatio. The risk of the auditor being sued because of association with an audit client. Protect the auditor in the event of litigation.

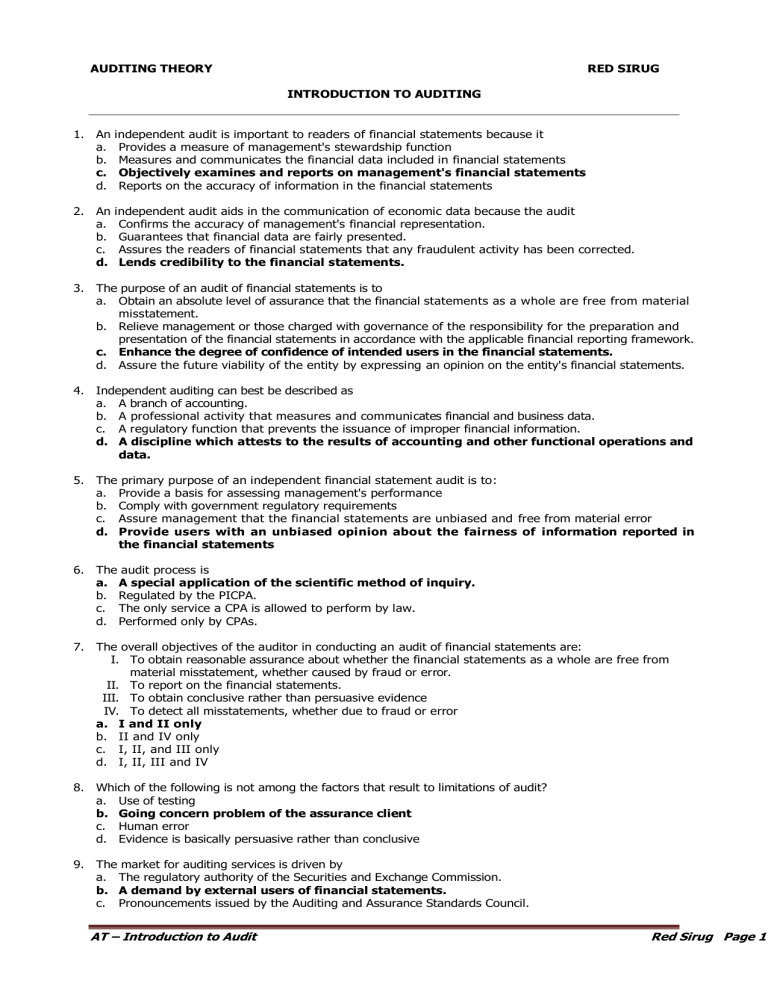

A systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between these assertions and established criteria and communicating the results thereof. Before knowing what is an audit in context of financial account lets understand what is an Audit actually. Fundamental Concepts in Conducting a Financial Statement Audit.

Recommend uses for information. The best statement of the responsibility of the auditor with respect to audited financial statement is. Which of the following best describes the roles of the American Institute of Certified Public Accountants AICPA and the Public Company Accounting Oversight Board PCAOB in establishing auditing standards.

We review their content and. Experts are tested by Chegg as specialists in their subject area. View the full answer.

A Auditing standards issued by the AICPA and the PCAOB are considered minimum standards of performance for auditors. What is an audit in the context of financial accounting. The purpose of the internal audit activitys evaluation of the effectiveness of existing risk management processes is to determine that.

Users of the statements may not fully understand the consequences of their actions b. What best describes the word assurance in the context of the Philippine Standards on Auditing. The study of auditing focuses on learning the analytical and logical skills necessary to evaluate the relevance and reliability of information.

Accounting paper flow and diversification of accounting procedures the more appropriate and useful are flow charts. The authority of the internal audit activity is limited to that. To gather corroborative evidence.

For example failing to qualify when the financial statements contain a material error. Entrepreneurship takes place in small businesses. Improve the quality of information or its context for decision makers.

In auditing accounting data the concern is with a. Level of assurance which may be provided is determined by the reporting objective. Internal auditing is a dynamic profession.

What best describes the purpose of the auditors consideration of internal control in a financial statement audit for a nonpublic company1 To determine the nature timing and extent of audit testing2 To make recommendations to the client regarding improvements in internal control3 To train new auditors on accounting and control systems4 To identify opportunities for fraud. AICPA ADAPTED d 4. In the context of agency theory information asymmetry refers to the idea that.

If this information is lacking the audit files are deficient. Communicating the auditors findings to the reader. Audit Risk is the risk of giving an inappropriate opinion on the financial statements.

Which of the following best describes the concept of audit risk. Impact of using different accounting methods may not be fully understood by the. What is an audit in the context of financial accounting.

Expressed positively in the report. The study of auditing can be valuable to future accountants and business decision makers whether or not they plan to become auditors. To comply with generally accepted accounting principles.

It wasnt really until recently Bob Dohrer replied that there has been some movement towards understanding auditor bias plays a significant role. Audit Risk has three individual components in the formula. The audit of the financial statements relieves management of its responsibilities b.

In summary it is essential that we have adequate infor mation in our files which outlines the clients accounting procedures and our opinion on the internal control. Formal education in auditing and accounting. One of these conditions is consequence.

In this context consequence means that the a. Perform market analyses and cost estimates. To verify the accuracy of account balances.

Comments

Post a Comment